flow through entity irs

Flow-through entities are also known as pass-through entities or fiscally-transparent entities. Flow-through entities FTEs affect an individuals Foreign Tax Credit FTC by impacting foreign source gross income foreign s ource taxable income worldwide gross income worldwide taxable income and foreign taxes available for credit.

The Florida Healthcare Law Firm Is Happy To Assist You With Any Healthcare Business Transaction Needs You May Have Be Law Firm Healthcare Business Health Care

In the end the purpose of flow-through entities is the same as that.

. General FTE Tax Credit. Common types of FTEs are general partnerships limited partnerships and limited liability partnerships. Form W-8 IMY may serve to establish foreign status for purposes of sections 1441 1442 and 1446.

The following types of common flow-through entities may elect to pay the flow-through entity tax in Michigan. More states considering passthrough entity taxes February 2021 IRS allows entity-level taxes as SALT deduction limitation workaround November 2020 California Senate bill proposes pass-through entity tax January 2021 Connecticut enacts responses to federal tax reform affecting corporations pass-through entities and individuals June 2018. A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax.

The IRS issued guidance Notice 2020-75 that seems to confirm a PTEs ability to deduct certain entity-level state income taxes from the federal taxable income that it passes through to its owners. In this legal entity income flows through to the owners of the entity or investors as the case may be. The resulting avoidance of.

Estimated payments are required to be made quarterly if the annual tax liability is more than 800. Its gains and losses are allocated or flow through to those with ownership interests. The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

Flow-Through Entity FTE Tax Credit. IRS issues notice on pass-through entity tax deduction. The Department of Treasury is automatically waiving penalty and interest for the late filing of FTE tax returns due on March 31 2022.

These parties then report the gains and losses on their own tax returns. Hence the income of the entity is the same at the income of the owners or investors. The majority of businesses are pass-through entities.

Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated payments due for tax year 2021. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. Key Takeaways A flow-through pass-through entity is a legal business entity that passes all its income on to the owners or investors.

FTE Tax Credit FAQs. Flow-through entities are a common device used to avoid double taxation on earnings. If you have payroll you likely already have one.

Any flow-through entity making a 2021 election after the due date of the flow-through entity tax annual return March 31 2022 for calendar year filers. Flow-Through Entity Tax Ask A Question Figures Needed for FTE Reporting. The waiver will be effective for a period of 6 months.

As a result many states have passed or have legislation pending that allows a PTEs. A Flow-Through Entity Tax Your Payment Select Flow-Through Enti Enter your payment amounts in the Tax Amount Penalty Amount and Interest Amount fields for each tax type below. Payments Made to Foreign Intermediaries and Foreign Flow-Through Entities.

FTE Tax Credit FAQ. The return and any payment must be filed through MTO. Payments made to a foreign intermediary or foreign flow-through entity are treated as made to the payees on whose behalf the intermediary or entity acts.

The entity calculates taxable income before the owners compensation. The flow-through entity tax payments will be made via Michigan Treasury Online MTO Michigan Treasury Online. FTE Tax Credit and Michigan IIT Return Form MI-1040 FTE Tax Credit and Michigan Composite IIT Return Form 807 FTE Tax Credit and Michigan Fiduciary IIT Return Form MI-1041.

This means that the flow-through entity is responsible for the taxes and does not itself pay them. Partner of a partnership must report the partners distributive share of the partnerships gains income deduction s losses or credits on. With flow-through entities the.

Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Once the payment is made the payment will remain as a PTE elective tax until a tax return. Flow-through entities are considered to be pass-through entities.

The IRS released guidance on Nov. Pass-through entities also called flow-through entities roughly follow the same tax-paying process. So you may need to have an account established with them.

That is the income of the entity is treated as the income of the investors or owners. Understanding What a Flow-Through Entity Is. 9 Notice 2020-75 agreeing that pass-through entity PTE businesses may claim entity-level deductions for state income tax paid under state laws that shift the tax burden from individual owners to the business entityThe guidance clarifies uncertainty on the issue and supports partnerships and S corporations deducting tax payments.

Branches for United States Tax Withholding and Reporting including recent updates related forms and instructions on how to file. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. If you dont that is a process youll have to work through and pretty quickly.

A flow-through entity is a legal entity where income flows through to investors or owners. Limited liability companies LLCs that file federal income tax returns as partnerships Partnerships including limited partnerships limited liability. Common Types of Pass-Through Entities.

Branches for United States. An annual flow-through entity tax return will be required to be filed by the last day of the third month after the end of the taxpayers tax year March 31 for calendar year filers. Every profit-making business other than a C corporation is a flow-through entity including sole proprietorships.

Flow-through entities are used for several reasons including tax advantages.

Fatca Classification Of Trusts Flowchart Financial Institutions Investing Flow Chart

Irs To Delay Start Of Tax Filing Season By Two Weeks Filing Taxes Tax Attorney Tax Debt

A Limited Liability Company Llc Is Not A Separate Tax Entity Like A Corporation Instead It Is What The Ir Limited Liability Company Tax Sole Proprietorship

W9 Form 2020 W 9 Forms Regarding 2021 W9 Form In 2021 Irs Forms Calendar Template Calendar

New 2022 Irs Changes Funds Partnerships Required Schedule K 2 And K 3 Us Tax Financial Services

What Company Name To Choose For Your New Llc Limited Liability Company Company Company Names

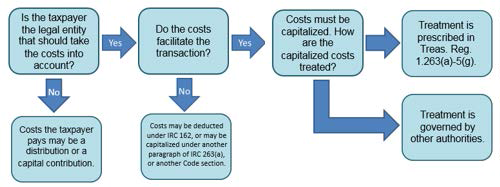

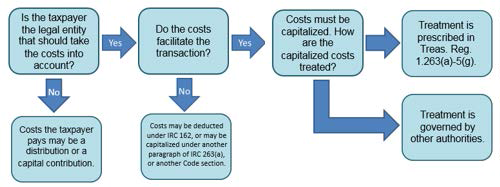

Irs Releases Practice Unit On Examining Transaction Costs Tax Controversy 360

4 Types Of Businesses Business Basics Business Marketing Plan Simple Business Plan

Business Ownership Structure Types Business Structure Business Basics Small Business Bookkeeping

Advantages To A Limited Liability Company Limited Liability Company Liability Online Marketing

S Corp Tax Return Irs Form 1120s White Coat Investor In 2021 Irs Forms Tax Return White Coat Investor

Here Are Some Accounting Tips To Ensure An Error Free Accounting And Business Growth Accountingtips Accoun Cloud Accounting Accounting Accounting Software

New Irs Collections Policy Introduced Tax Taxadvisors Taxlaw Taxdeduction Taxplanning Taxtips Taxguide Guide Consu Tax Guide Tax Deductions Tax Debt

Understanding Flow Through Entities Like S Corporations And Llc S Pace Accounting

S Corporation Formation Services Ez Incorporate Business Names Improve Yourself Business

Login Uml Sequence Sequence Diagram Diagram Ford Granada

What Is An Irs 1099 Form Purpose Who Gets One Nerdwallet In 2021 Irs 1099 Tax Form Tax Forms

Factors Affecting Women S Economic Well Being Across The Lifecycle Flwomenandmoney Personal Budget Economic Well Being Managing Your Money

Virtual Bookkeeping Checklist The Basics For Small Businesses Bookkeeping Business Finance Business Management